Nov 15, 2024

Overview

Alkimiya is launching a Base L2 Gas market. Users can buy or sell a percentage of the Total Gas Spent on Base rollup for a period of time (e.g. buy 1% of the Total Gas Spent of all Base blocks in a month). Since the Total Gas Spent is also the revenue earned by the sequencer, this product serves as a proxy to Base ecosystem’s fundamentals.

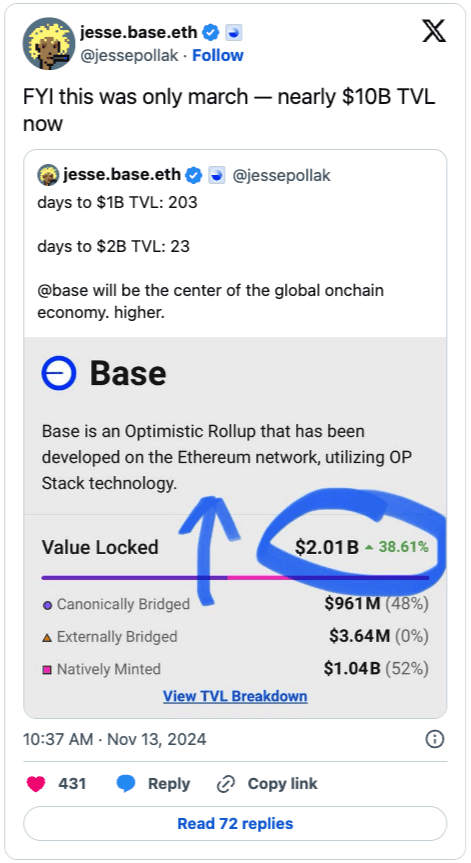

Launched in August 2023, Base has rapidly emerged as one of the fastest-growing communities. It has not only attracted a vibrant and engaged user base but has also established itself as a leader by generating the highest revenue amongst its peers.

Revenue: L2 Transaction Fees (USD). Source: Dune

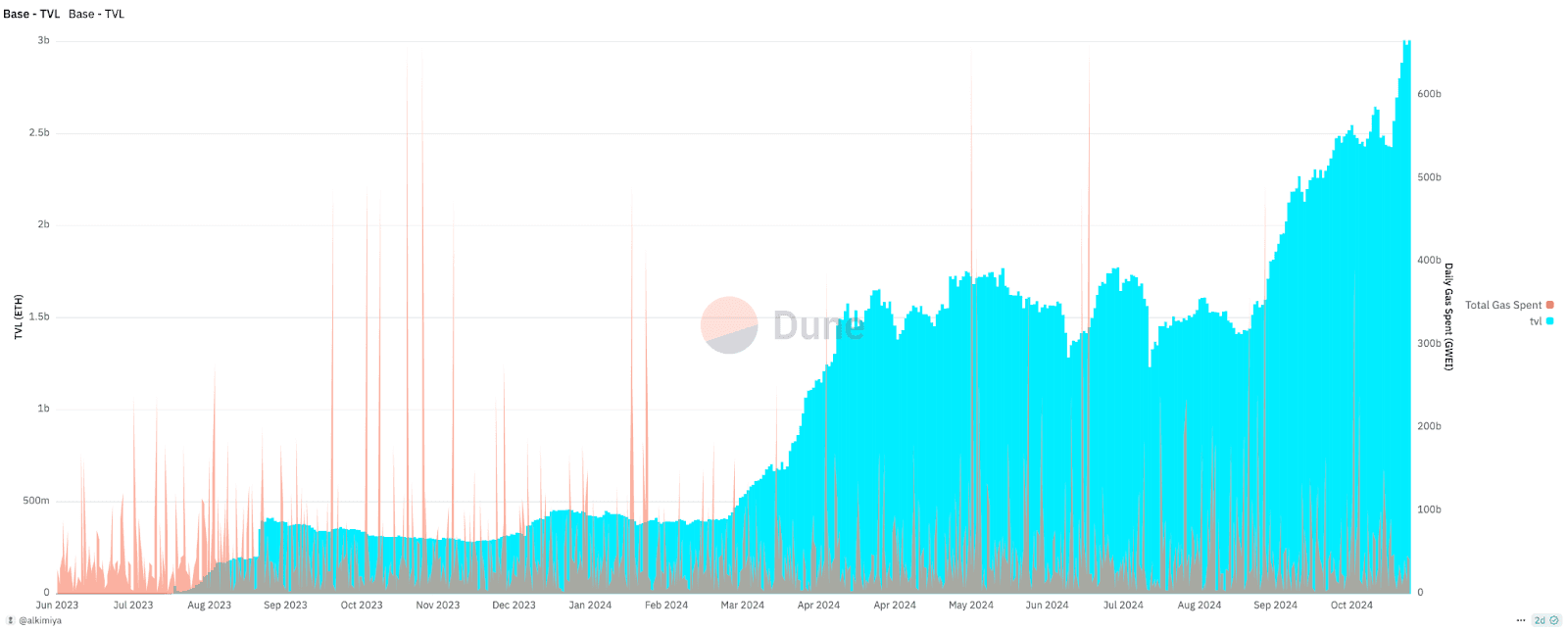

The rise and fall of Total Gas Spent is the barometer of the utilization rate of its blockspace resources. Generally speaking, the more users that use Base, the greater the cumulative Total Gas Spent will be.

Trading Total Gas Spent represents a unique way of betting on the fundamental growth of an ecosystem, without interacting with the platform’s governance tokens, and in this case, Base doesn’t have a token.

How does this market work?

We can assess a number of leading indicators when projecting the revenue growth of an ecosystem. Since L2 gasPrice is almost negligible after EIP-4844, this metric is mostly affected by the volume of activity.

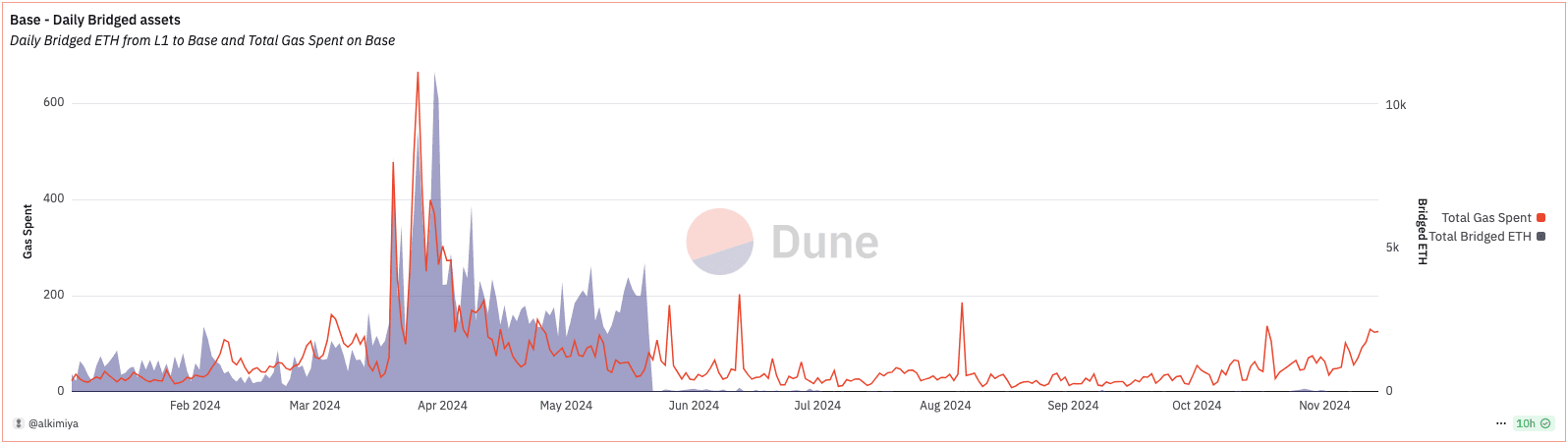

TVL and net assets bridged are the two most direct metrics. However, they provide only a low-resolution view of the market. There is no information regarding what or how actively the assets are traded.

Base - TVL. Source: Dune

Base - Daily bridged assets. Source: Dune

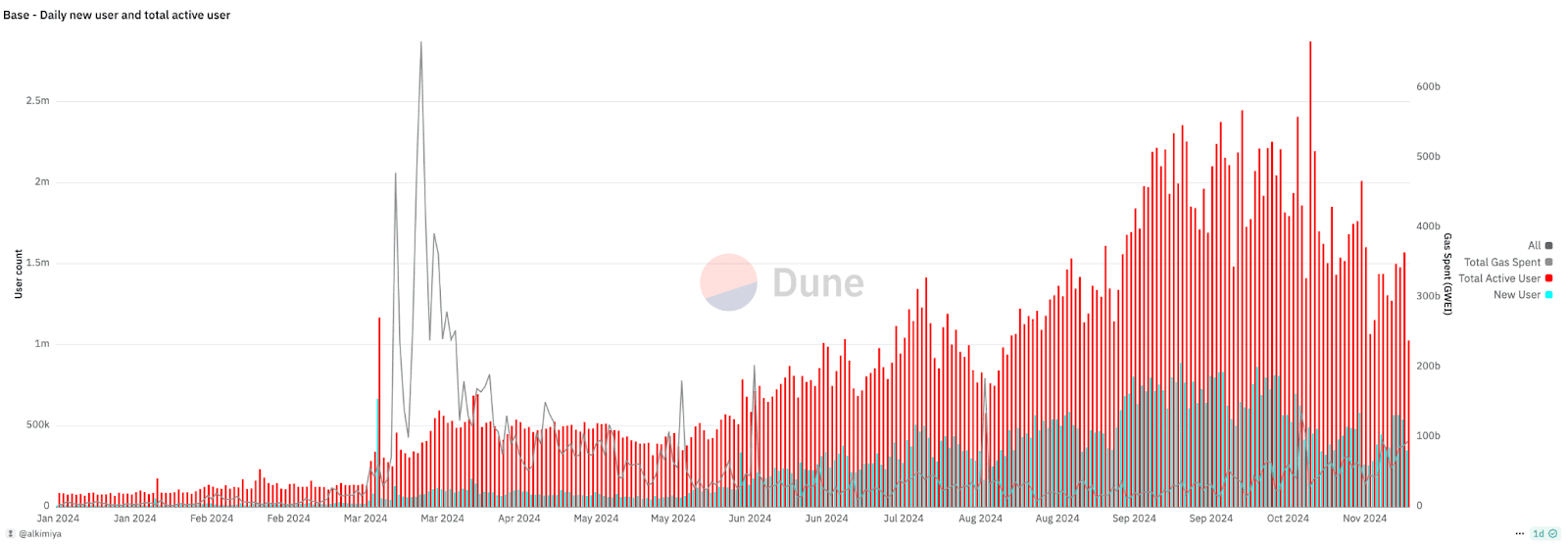

In addition, while metrics such as Total Active Users and New Users can be useful indicators of an ecosystem's growth over a long period of time, the correlation between user-related metrics and Total Gas Spent is not meaningful over the short term.

Base - Daily new users and total active users. Source: Dune

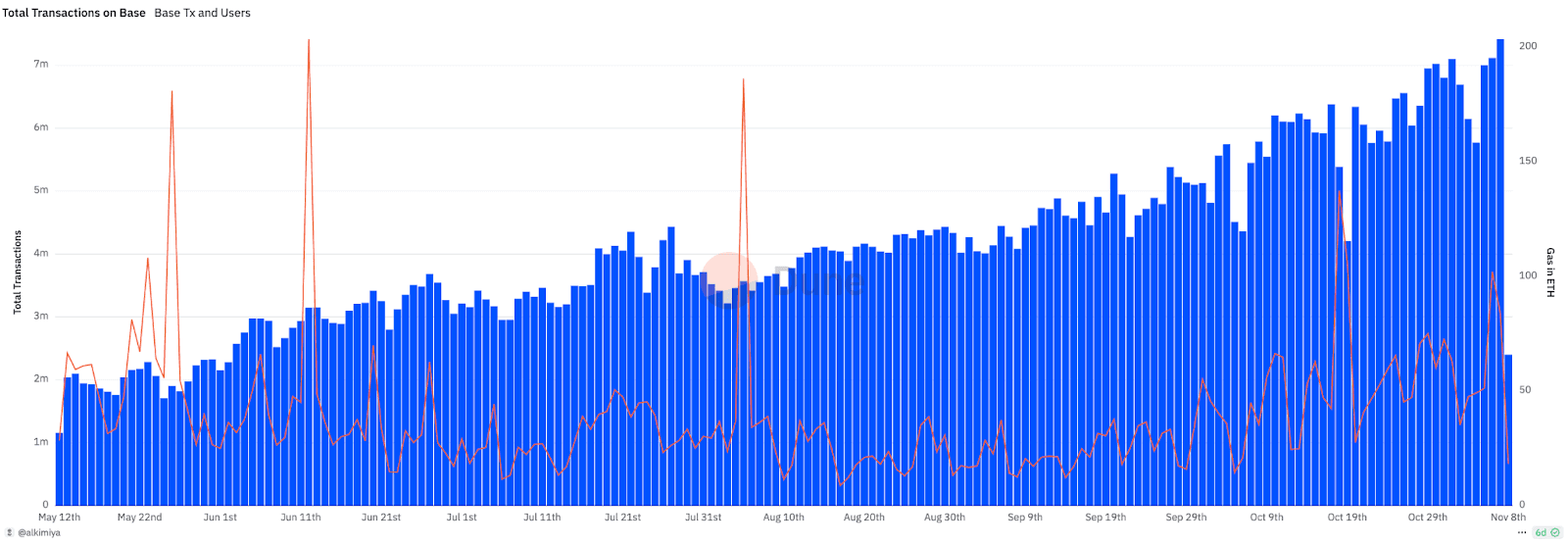

As a consequence, user-related metrics alone do not provide sufficient information about how assets are being utilized on-chain. Metrics related to transactions should be examined:

Total Transactions on Base. Source: Dune

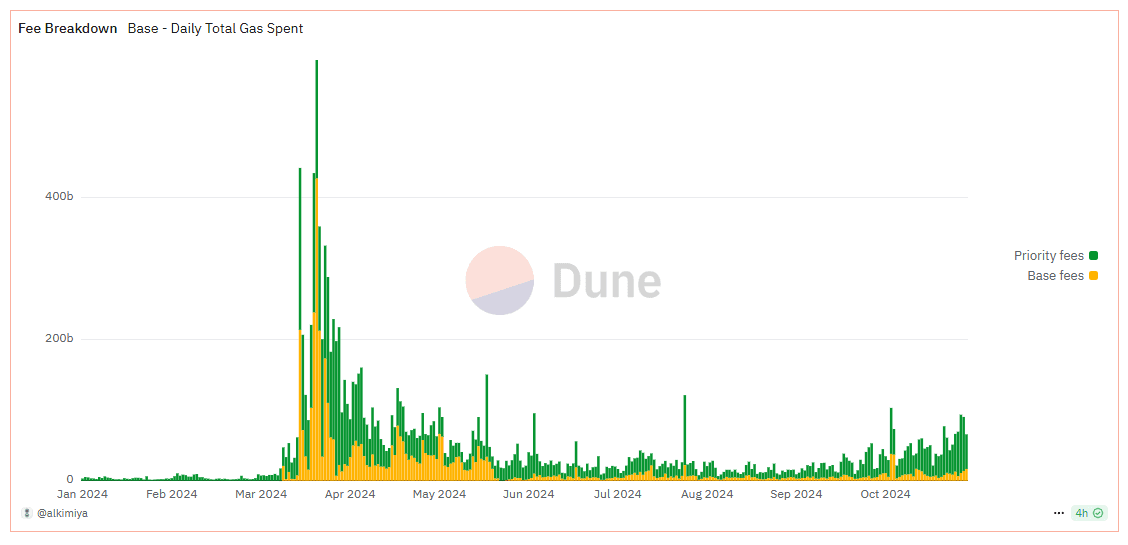

Not all transactions are the same. Users will pay higher priorityFee for high-value transactions or MEV opportunities. Data shows that majority of the Total Gas Spent comes from priorityFee:

Base - Daily total gas spent breakdown. Source: Dune

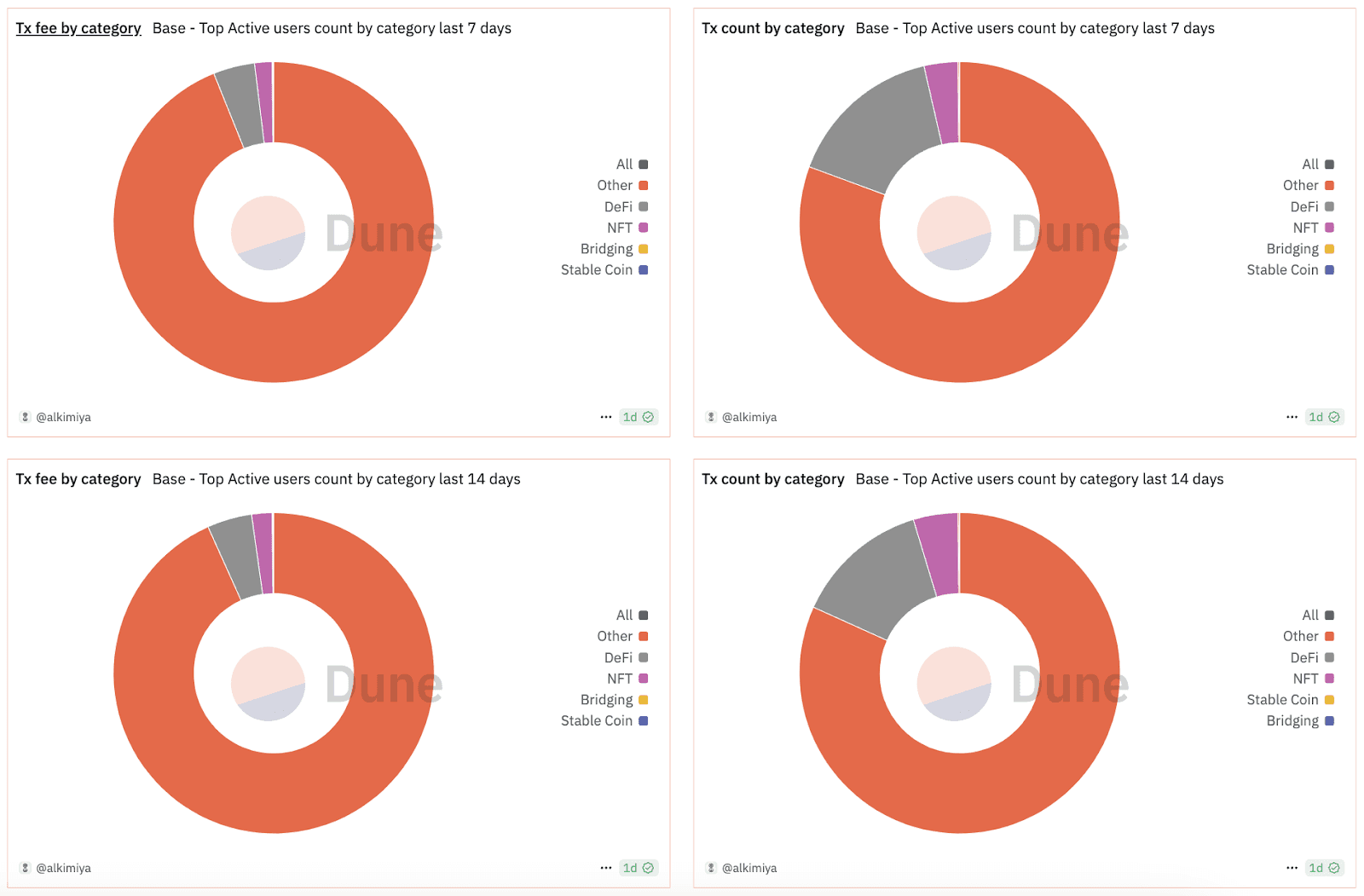

We can gain a better understanding of the dynamics by breaking transactions into various categories:

Tx fee by category & Tx count by category. Source: Dune

To illustrate how Total Gas Spent changes as the composition of transaction types changes, we can layout the distribution of dapp usage on a daily basis:

Base - Daily dApp gas usage. Source: Dune

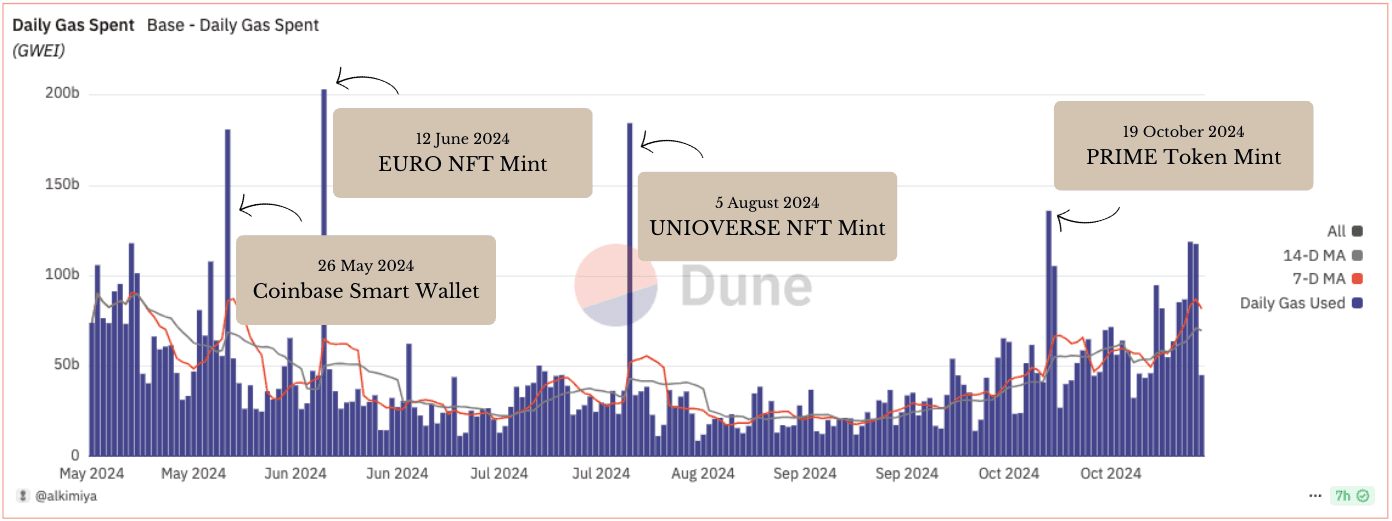

The majority of high-value transactions are the result of well-telegraphed events, such as NFT mints. This is a well-understood phenomenon. To dive deeper into the impact of on-chain events and gas decay, please read our research: Things Hidden Since the Foundation of Blockspace.

The Base Gas markets serve as continuous predictions of how on-chain activities will change over time, particularly around large events such as NFT mints, surges in certain memecoins, or airdrops.

Base - Daily gas spent (GWEI). Source: Dune

Take Alkimiya’s BTC Feerate market for example, traders were able to take advantage of on-chain events such as Babylon Cap-1 launch, Magic Eden airdrop, and popular Rune mints.

In August 2024, the launch of Babylon’s Bitcoin Staking Program Cap-1 caused a 90x spike in BTC transaction fees, jumping from approximately 8 sat/vB to 717 sat/vB within a single block. Successful stakers spent a total of 53.405 BTC ($3.4m) in fees while unsuccessful stakers spent an additional 4.723 BTC ($0.35m) to unbond their transactions. During this period, 16.039 BTC ($1.4m) was hedged on Alkimiya with PnLs seeing a high of ~190%.

In October 2024, Runes activity surged once again, leading to over 150 BTC ($13.5m) spent in fees. This was due to a number of Runes mints including but not limited to $PUPS, $FRIDGE, $YOURMOM, $POOKA, $CYPHER. During this period, 74.336 BTC ($6.7m) was traded on Alkimiya with PnLs seeing a high of ~315%.

Mechanism

A pool on Alkimiya is the set of all LONG and SHORT positions within the same period. Users can enter anytime during the pool’s period. The index tracks the Total Gas Spent per block. The UI will display ‘per Day’ since the Base block time is 2s.

If you think Base L2 revenue is going to pick up over the next two weeks, by taking a LONG position, you're anticipating that the Total Gas Spent by users ends up higher than when you entered the position.

Expecting Base L2 revenue to drop over the next two weeks? Or if you think the market is currently overpriced, you may want to hedge against that by taking a SHORT position. In this case, you're speculating that the Total Gas Spent by users will end up lower than your entry price.

At the end of the pool period, you can claim your rewards (wETH) from the pool. The final payout is based on the cumulative Total Gas Spent over the pool’s period.

To learn more about the mechanism details, please read Base Gas Market Specs and Documentation.

Exogenous factors

Raising gas limit: Base rollup periodically raises the gas target. This effectively lowers gasPrice. Read more.

L1 cost: sequencers batch transactions to ETH L1 to settle transactions. While blobs are currently very affordable, this may change if blobspace enters the price discovery phase. Read more.

OP Superchain rent: The rent paid to Optimism could potentially change, and therefore impact L2 gasPrice. Read more.

Account abstractions: As paymasters get mass adoption (possibly via Coinbase Smart Wallet) users may pay gas in different currencies. The revenue for the sequencer may become complicated to account for multiple currencies. Read more.

Based rollup: Based rollups/appchains using the same pre-conf service or marketplace can achieve synchronous composability with each other as well as the L1. L2 sequencers economics might have to evolve if it gets adopted. However, this is largely an unknown territory. Read more.

At Alkimiya, we are thrilled by the Base team’s unmatched dedication to fostering community growth and their ambitious mission to onboard the next billion users on-chain. The Base Gas market offers a unique and direct avenue to engage with the core fundamentals of the Base ecosystem, empowering participants to become an integral part of its growth and success.