Nov 8, 2024

“Memory can change the shape of a room; it can change the color of a car. And memories can be distorted. They're just an interpretation, they're not a record, and they're irrelevant if you have the facts.”

— Christopher Nolan, Memento

0xCheeezzyyyy, Samantha Tan, Leo

Special thanks to @howry_ for the insights and inspiration leading to this content.

On 31st October 2024, the mint of Rune MEMENTO•MORI caused a significant spike in BTC transaction fees.

The Rune was etched a week before on 22nd October by Casey Rodarmor, the inventor of Ordinals theory and creator of Runes. At a maximum supply of 100M, 50% of it was pre-mined and airdropped to Hell Money Pod’s - Rodarmor’s Bitcoin podcast - Patreon subscribers, while the remaining 50% was distributed through a public mint.

Source: UniSat

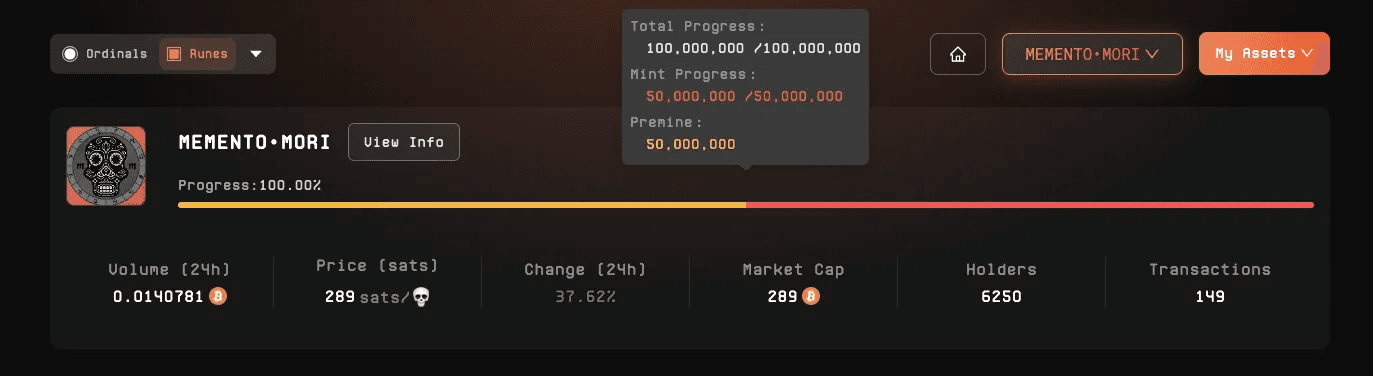

In the week leading up to the mint, the word was spread throughout the Rune community and beyond, which caused significant competition amongst minters. As a result, Bitcoin transaction feerates skyrocketed by 140 times, jumping from approximately 5 sats/vB to 700 sats/vB within a single block.

Source: Alkimiya BTC Transaction Fee Market Dashboard

2 days before the public mint, Alkimiya announced BTC•FEES•GASTOKEN – a special, one-time Rune that gives minters something no other collection does: an offset on their BTC transaction fees.

BTC•FEES•GASTOKEN tracks the average BTC feerate over a period of time. When feerate spikes, the value of these Runes follows, partially offsetting the exorbitant MEMENTO•MORI mint cost. At the end of the pool, the minters can redeem BTC•FEES•GASTOKEN for sats equal to actual average transaction fees.

Source: 0xCheeezzyyyy

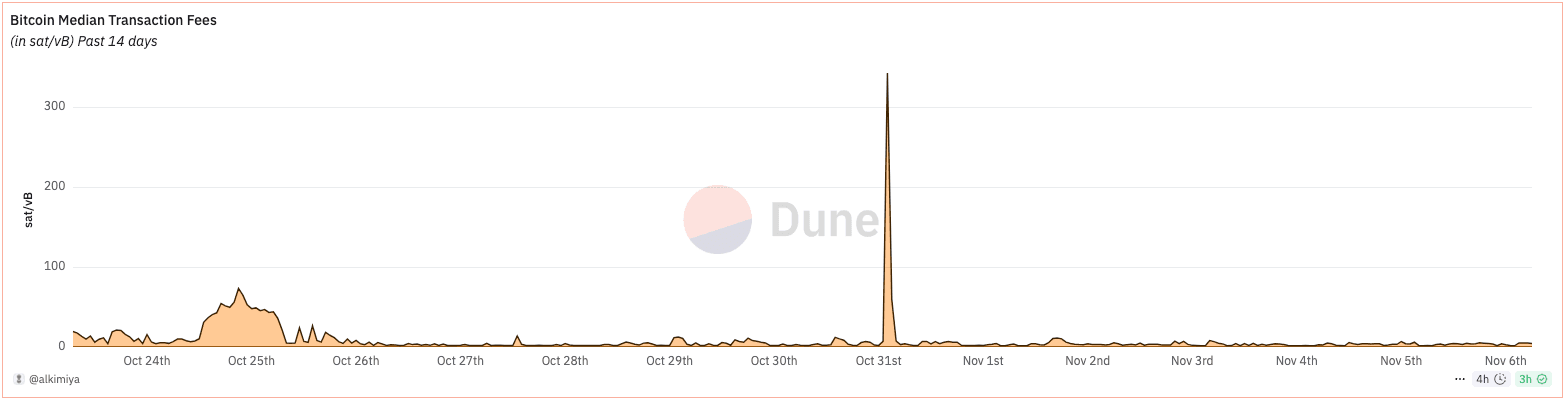

Before delving deeper into the mechanics, it's essential to understand the following:

Value of Satoshis (Sats) relative to BTC

Transaction size units (virtual Bytes, or vB)

(Transaction) Fee Rate (Sats/vB)

Median Fee Rate (Sats/vB)

Source: 0xCheeezzyyyy

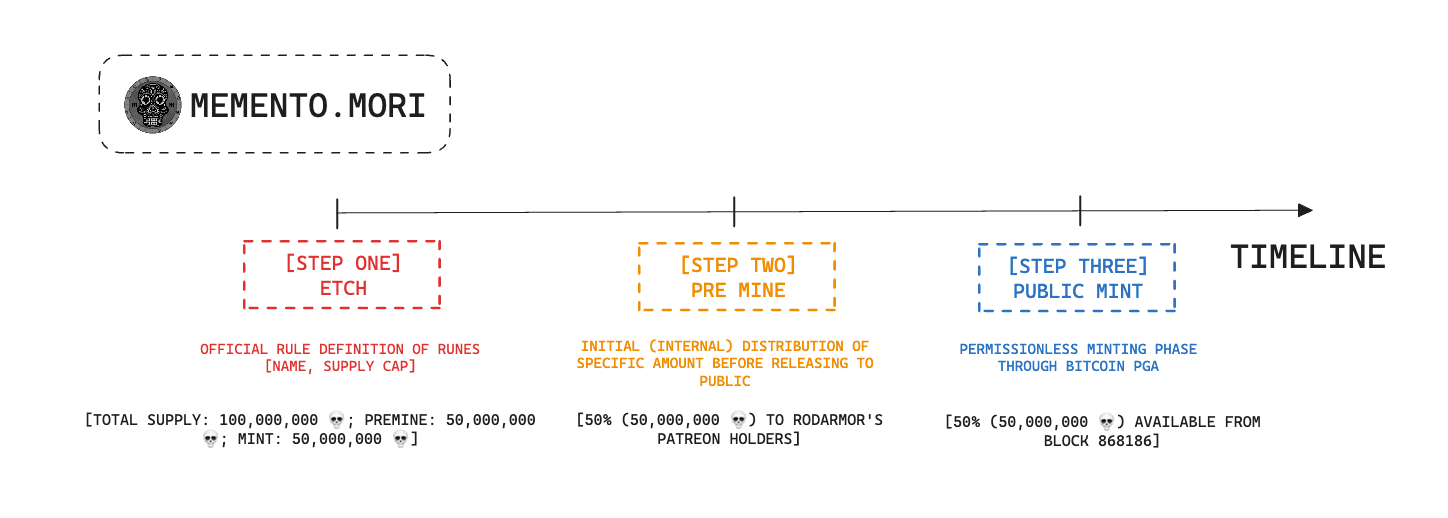

Runes typically have a 3-stage timeline:

Etching: Initialization of rules of Runes details (think of it as an NFT contract creation)

Premine: Deterministically minting a fixed supply for permissioned distribution

Mint: The public bidding phase to own the tokens

Source: 0xCheeezzyyyy

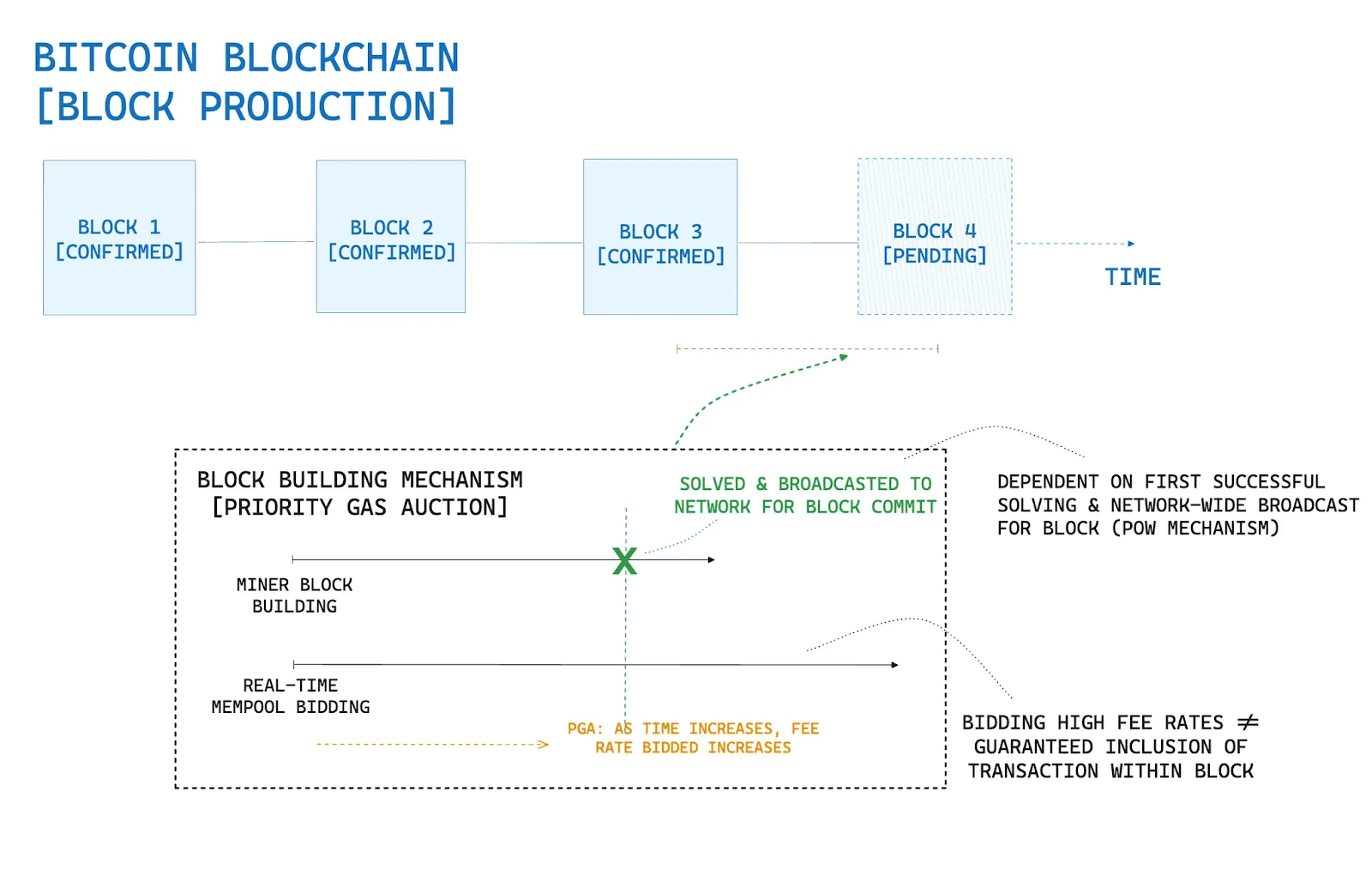

The public mint lasted ~10 blocks, subjected to Bitcoin's Priority Gas Auction (PGA). This created a race between the first successful miner versus real-time mempool bidding, often leading to a difference between expected and actual blocks.

Source: 0xCheeezzyyyy

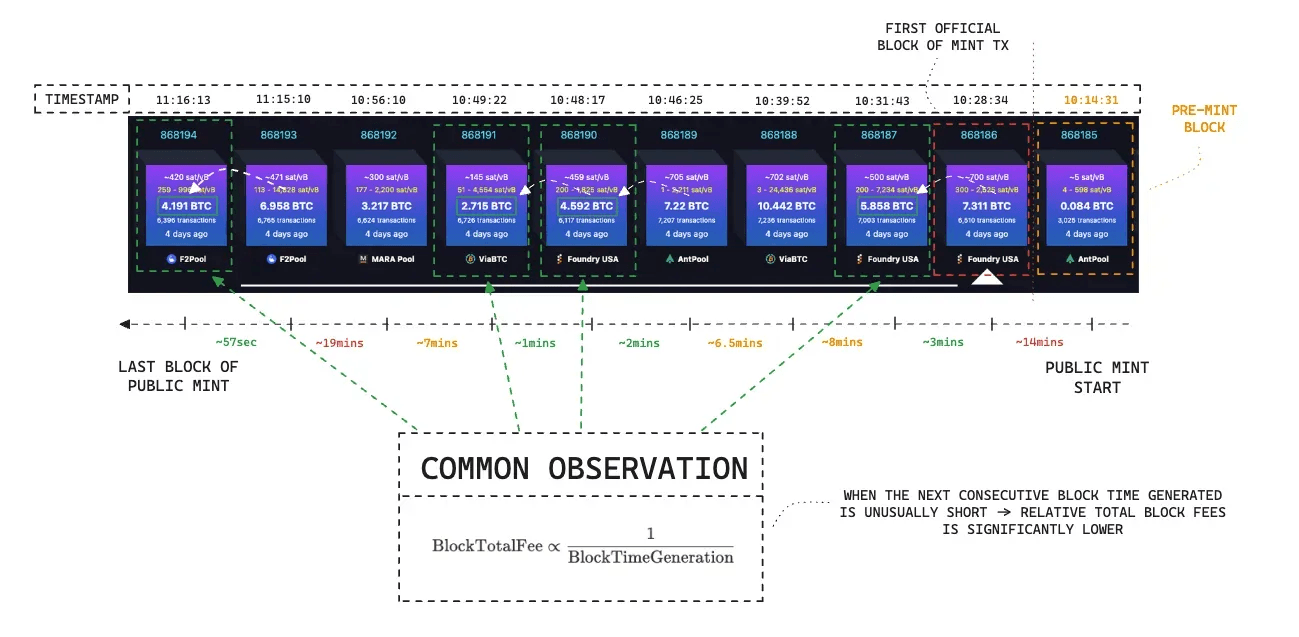

With reference to the first block of the mint, there is a huge -25.53% deviation in expected versus actual total fees.

The post-block fee rate were:

Expected: ~900 Sats/vB

Actual: ~700 Sats/vB

As time passed, the PGA intensified (higher bids), but miners had already been building prior to the latest bids, hence the lower actual feerate.

Source: 0xCheeezzyyyy via mempool.space

Not surprisingly, blocks that are produced unusually faster than average generation time (~10mins) have significantly lower total fees than the previous one. This corroborates with how the PGA works where lower bids are usually placed at the 'start' & increase towards the end.

Source: 0xCheeezzyyyy via mempool.space

Now, price action.

50% of premine supply were distributed before the public mint, which resulted in 2 market activities during the mint:

Magic Eden secondary market activity

First-hand minting

Prior to mint, secondary sale pressure bottomed at ~$8M MCAP before surging back.

Source: 0xCheeezzyyyy via Magic Eden

This PA felt like any NFT launch with an initial distribution with an ongoing public mint. However, the underlying cost for first-hand minting was WAY BELOW the secondary sale price on Magic Eden throughout the 10 blocks. This gap creates a clear profit opportunity for the minters.

Source: 0xCheeezzyyyy

Beyond base profitability, some minters’ profits are further enhanced by Alkimiya’s BTC•FEES•GASTOKEN.

BTC•FEES•GASTOKEN is exclusive to MEMENTO•MORI minters. For every 1000 of MEMENTO•MORI minted, one could claim 200 BTC•FEES•GASTOKEN. Since this is a limited one-time collection with a total supply of 2mm, the claim was on a first-come, first serve basis.

Each BTC•FEES•GASTOKEN is backed by LONG feerate positions on Alkimiya, which is equivalent to rewarding MEMENTO.MORI minters with 400vB LONG on median feerate per lot (1000 tokens). After Nov 3rd, BTC•FEES•GASTOKEN holders were able to redeem them for sats (wBTC) equal to the amount of tx fees the positions are tracking.

A total of 3464 addresses submitted their claims – and 58 of those addresses received 0.04 wBTC altogether.

This implies a partial mint cost off-set for:

6.15 BTC for 5-25 Sat/vB Pool

0.027 BTC for 25-45 Sat/vB Pool

totaling to 6.18 BTC of settlement at a (median) fee rate of 11.813 Sats/vB.

For 1 lot Mint:

The 58 verified addresses received (11.813-5) x 400 = 2725 Sats as rebate.

Source: 0xCheeezzyyyy, Howry_

Circling back to the 2021 NFT craze, we'd seen countless instant profitable mints that led to (a bit too) insane price discovery. Bitcoin Runes was only introduced <6 months ago, with the majority lack in understanding. Bitcoin math isn't rocket science, and the 'barriers to entry' is simply putting effort into learning. With blockspace market platform Alkimiya, advanced strategies can be employed to speculate & hedge against major events/activity.

Source: CryptoQuant