Aug 30, 2024

“I still believe that the world is arranged in our favor, since we can nevertheless gain mastery over things that run counter to our senses.”

― Stanisław Lem, Fiasco

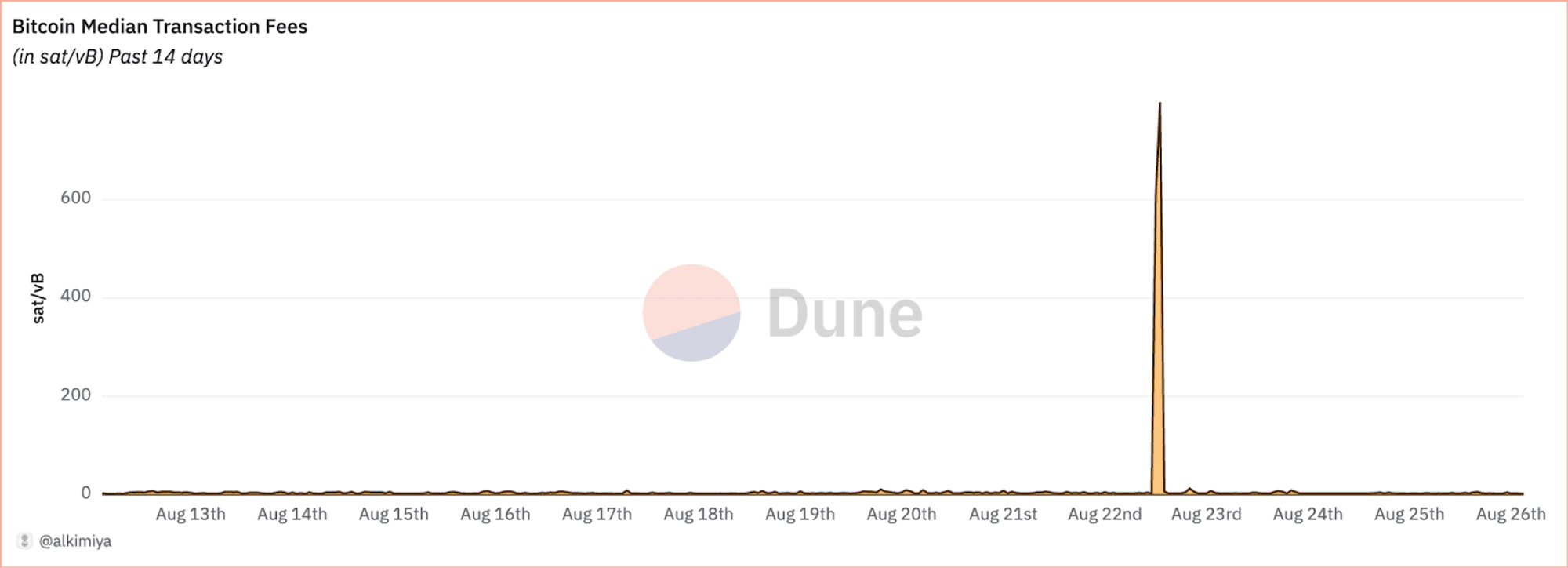

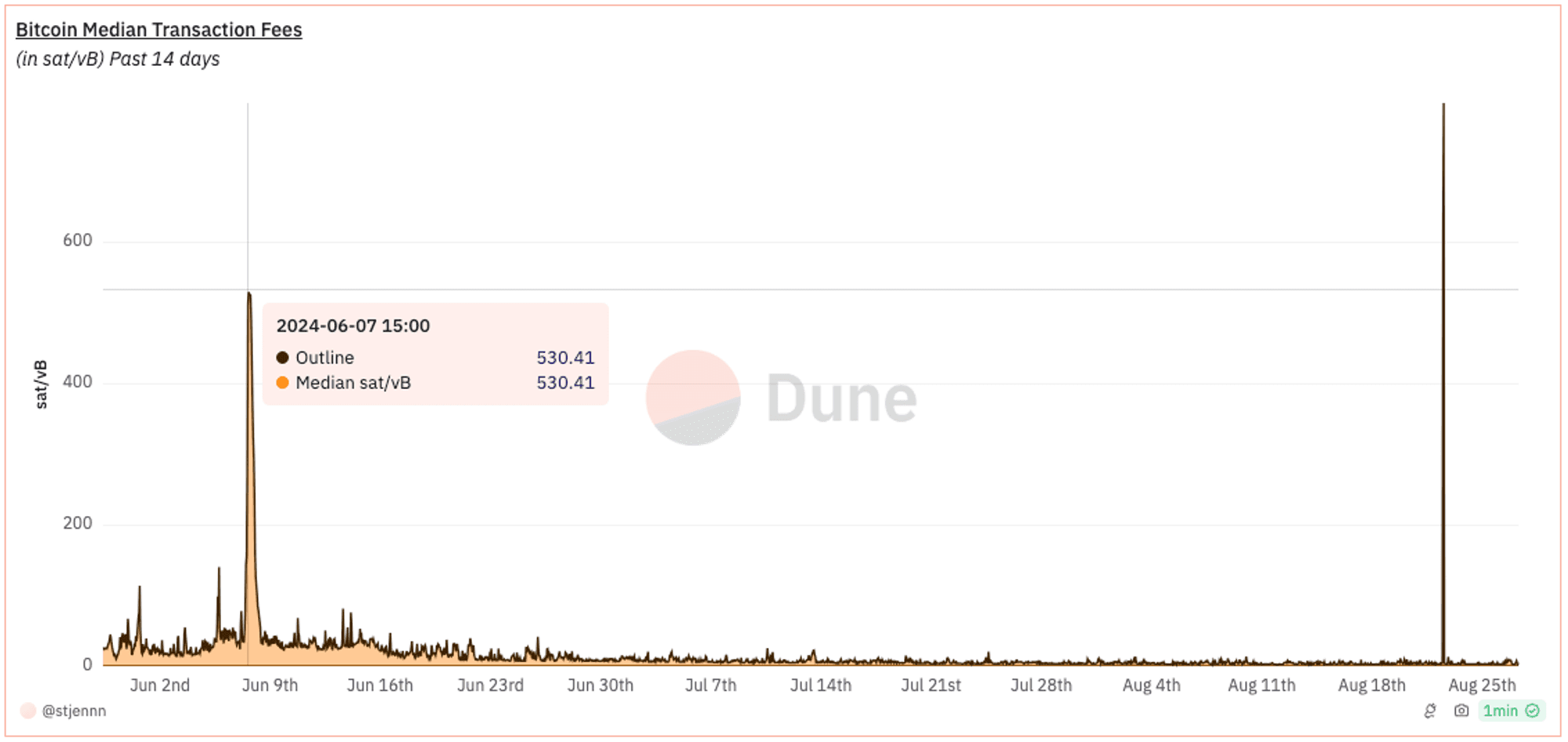

On 22nd August 2024, the launch of Babylon’s Bitcoin Staking Program - Phase 1 caused a significant spike in BTC transaction fees.

The launch was capped at 1,000 Bitcoins in total, with individual wallets capped at 0.05 BTC. To participate, stakers needed to get their transactions included on a first-come, first-served basis. This caused significant competition among stakers, as a result, Bitcoin transaction feerates skyrocketed by nearly 90 times, jumping from approximately 8 sat/vB to 717 sat/vB within a single block.

Bitcoin Median Transaction Fees. Source: Alkimiya BTC Transaction Fee Market Dashboard ⌛

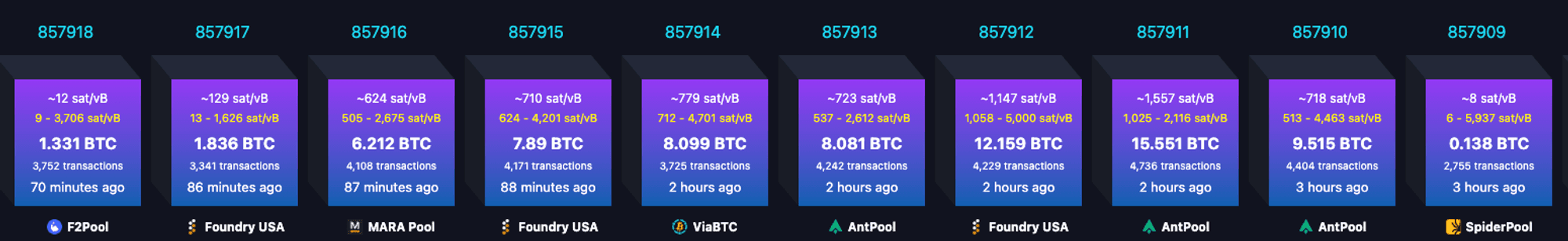

All staking transactions were processed within 5 Bitcoin blocks, spanning about 74 minutes. Users paid a staggering $3.4 million in fees, equivalent to roughly 53.405 BTC. After the staking blocks, the elevated feerate took another 5 blocks before reverting back to single digit:

Fee rate per block. Source: mempool.space

Fee rate during Babylon Phase 1 launch

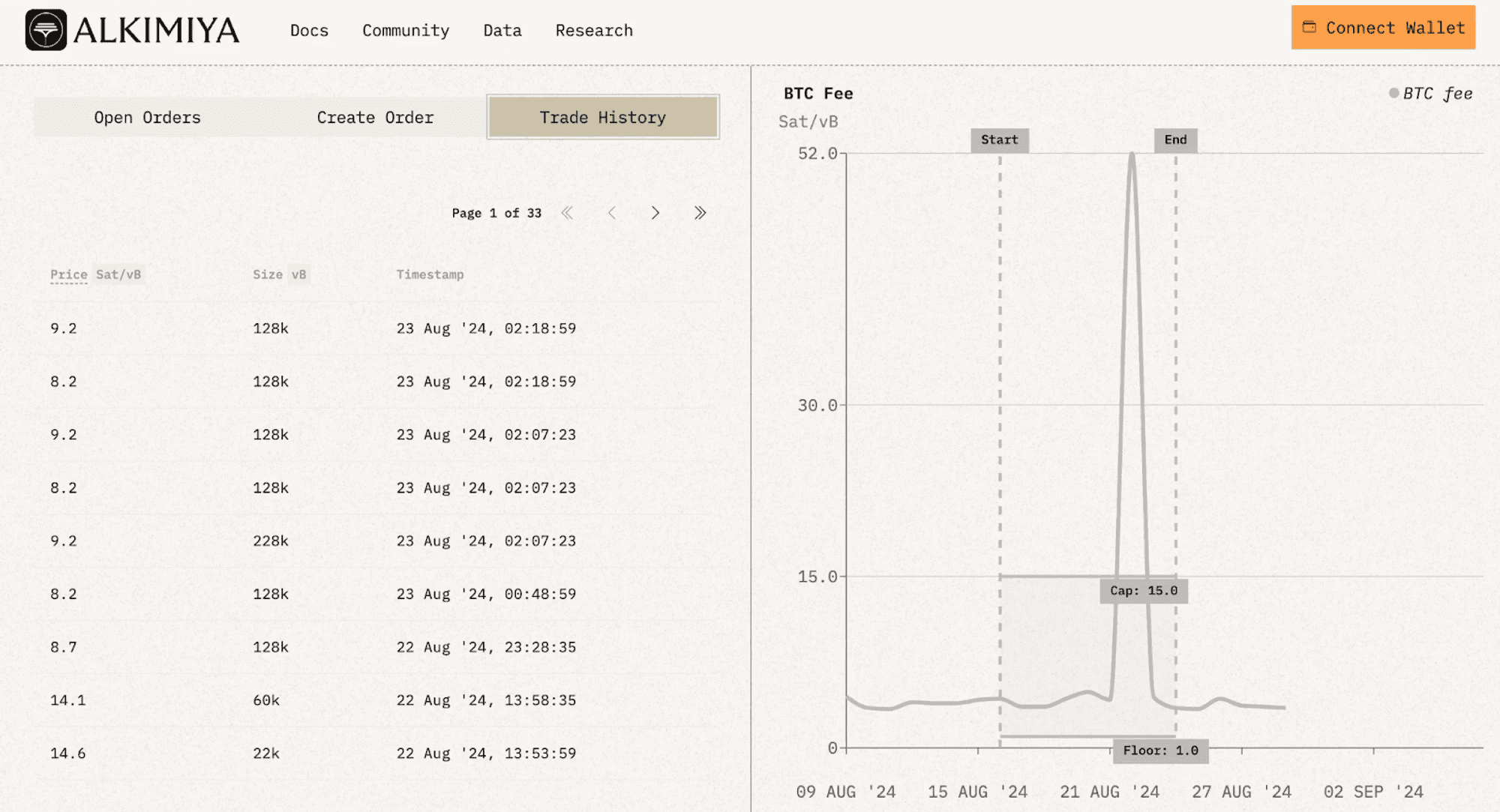

How Alkimiya Helped Stakers Capture Profit

The Bitcoin network is no stranger to congestions. In the past, average users and service providers had no recourse against such violent spikes. With Alkimiya, some users were able to profit from this event by taking a long position on feerate, and some LST projects who participated in the staking were able to offset some of their transaction cost.

Alkimiya Feerate Market

Alkimiya is a synthetic blockspace protocol where users can mint gas/fee tokens that track the ebb and flow of the network feerate. The higher the network feerate is, the more BTC these long positions are worth. Alkimiya launched on mainnet on July 25 2024.

On August 22nd, out of the 53.4 BTC in transaction fees incurred during Babylon launch, a total of 16.039 BTC was hedged via Alkimiya. Below are some PnL examples from users who took long positions during that week:

Long traders on Alkimiya Feerate Market

The Babylon staking transactions averaged around 0.00265 BTC per tx. Based on the average position size of 3.7M vB on Alkimiya during that period, the number of staking transactions a staker has hedged at different entry price levels can be approximated.

For example, a user who entered into a 3.5M vB long position at 4.1 Sat/vB would’ve paid a total of 0.1085 BTC, and collected a profit of 0.1645 BTC, which is equivalent to offsetting the transaction fees of 62 Babylon staking transactions.

In other words, to hedge a single Babylon staking transaction, the staker would need to collateralize 0.002 - 0.005 BTC, which is approximately 4-10% of the staking size, per transaction based on the entry price.

The volatility in fees creates a difficult environment for LST projects and frequent users. Many are forced into a challenging position: either absorb these costs entirely themselves, potentially threatening their financial stability or pass them on to users, risking user dissatisfaction and potential backlash.

The supply of blockspace is inelastic, and the demand is driven by exogenous factors. While scaling solutions can reduce the amount of full-node resources consumed, pricing the right to access them real-time is a fundamentally market-based challenge at global scale. Addressing market-based challenges requires market-based solutions. By abstracting attributes that represent blockspace resources (e.g. network average BTC Tx Fees), Alkimiya makes accurate price discovery on blockspace resources possible:

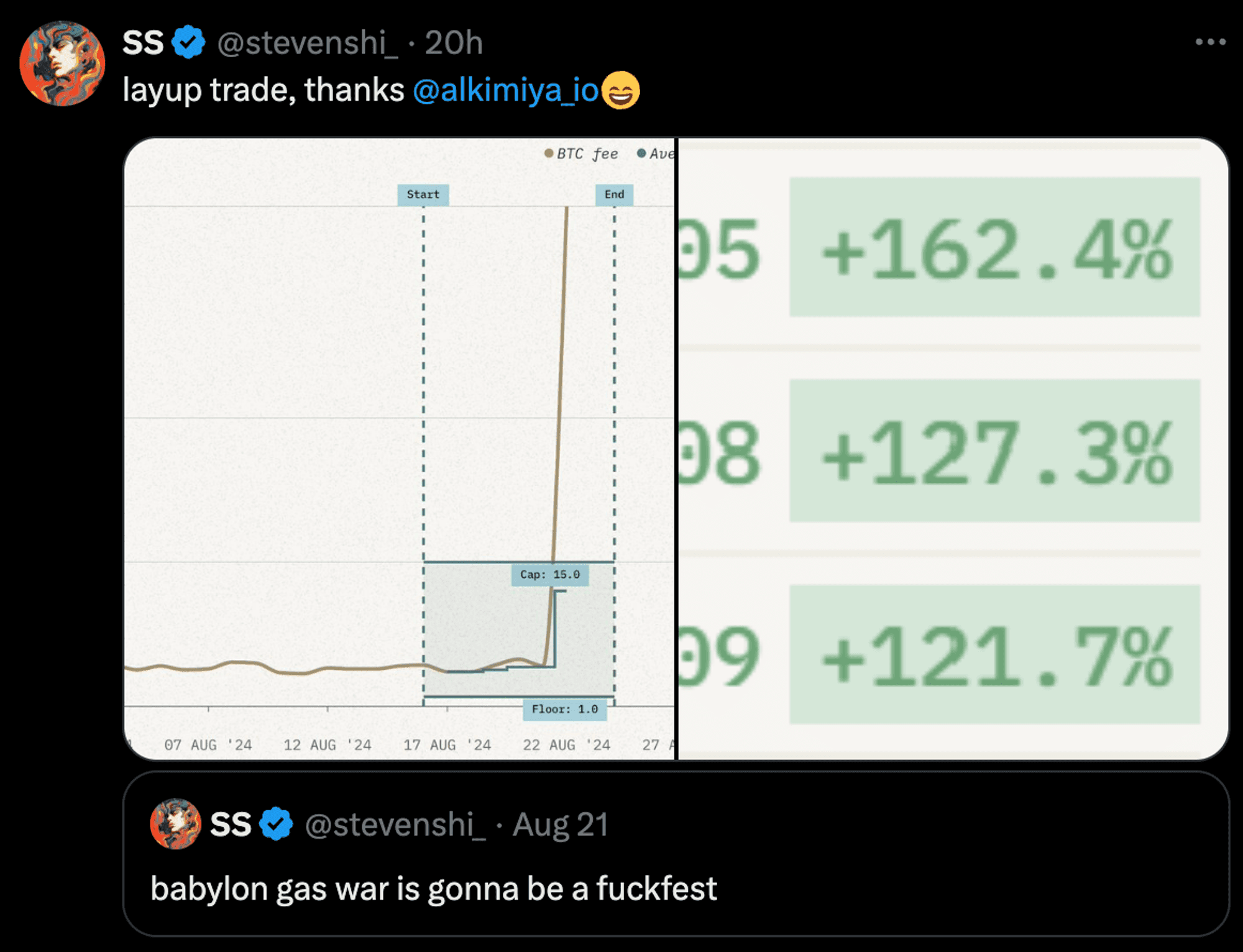

https://x.com/stevenshi_/status/1826803493337719061

https://x.com/bitcoinbeezy/status/1826694987557548257

Historical Feerate Spikes

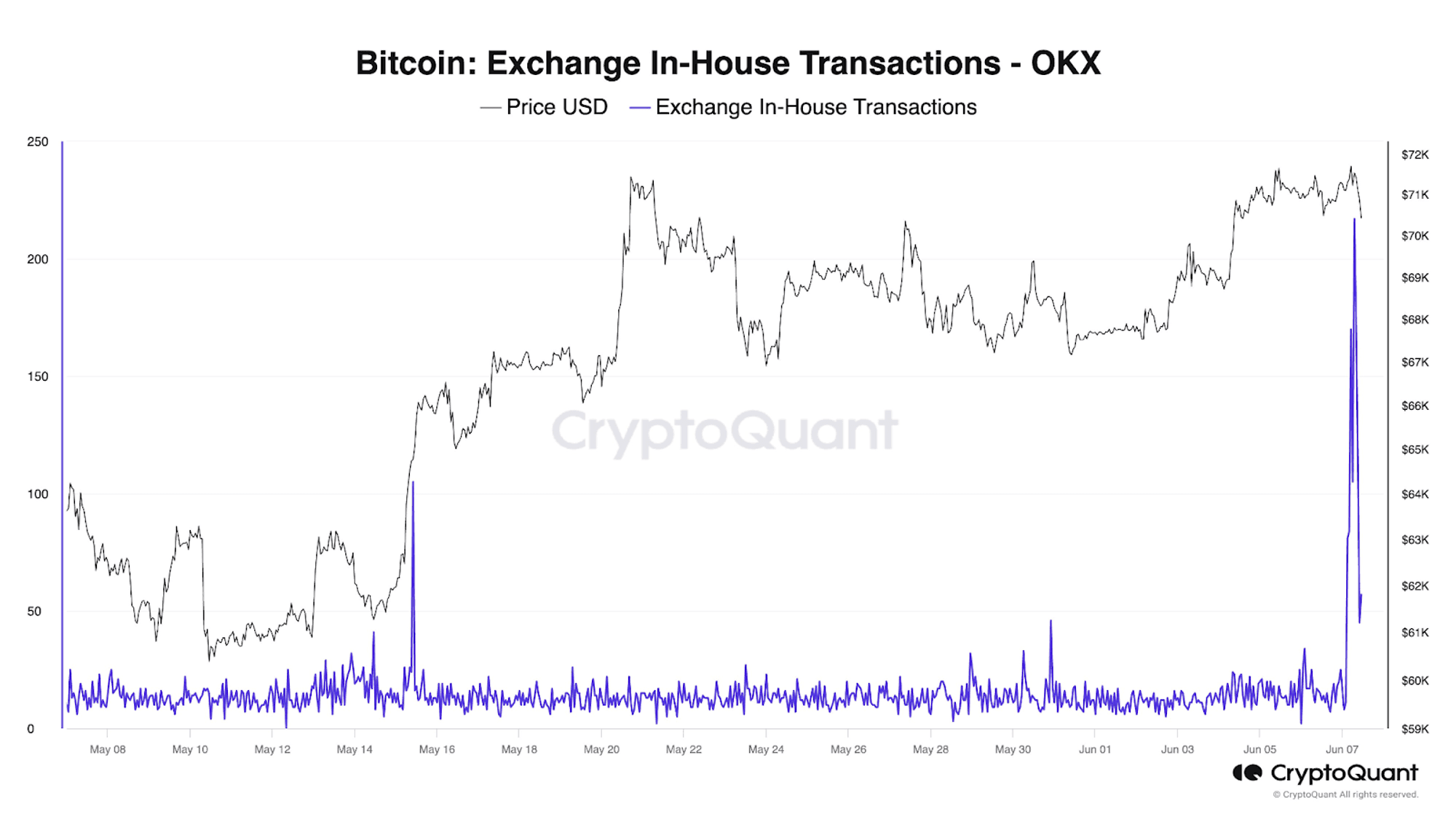

Bitcoin’s blockchain, like many others, faces periodic congestion due to high-profile events, new protocol launches, or large-scale operations by major players. For example, when Runes launched in April, the network incurred $162.4 million in fees over 15.6 million transactions in four months.

Bitcoin Runes total fees. Source: Dune Analytics

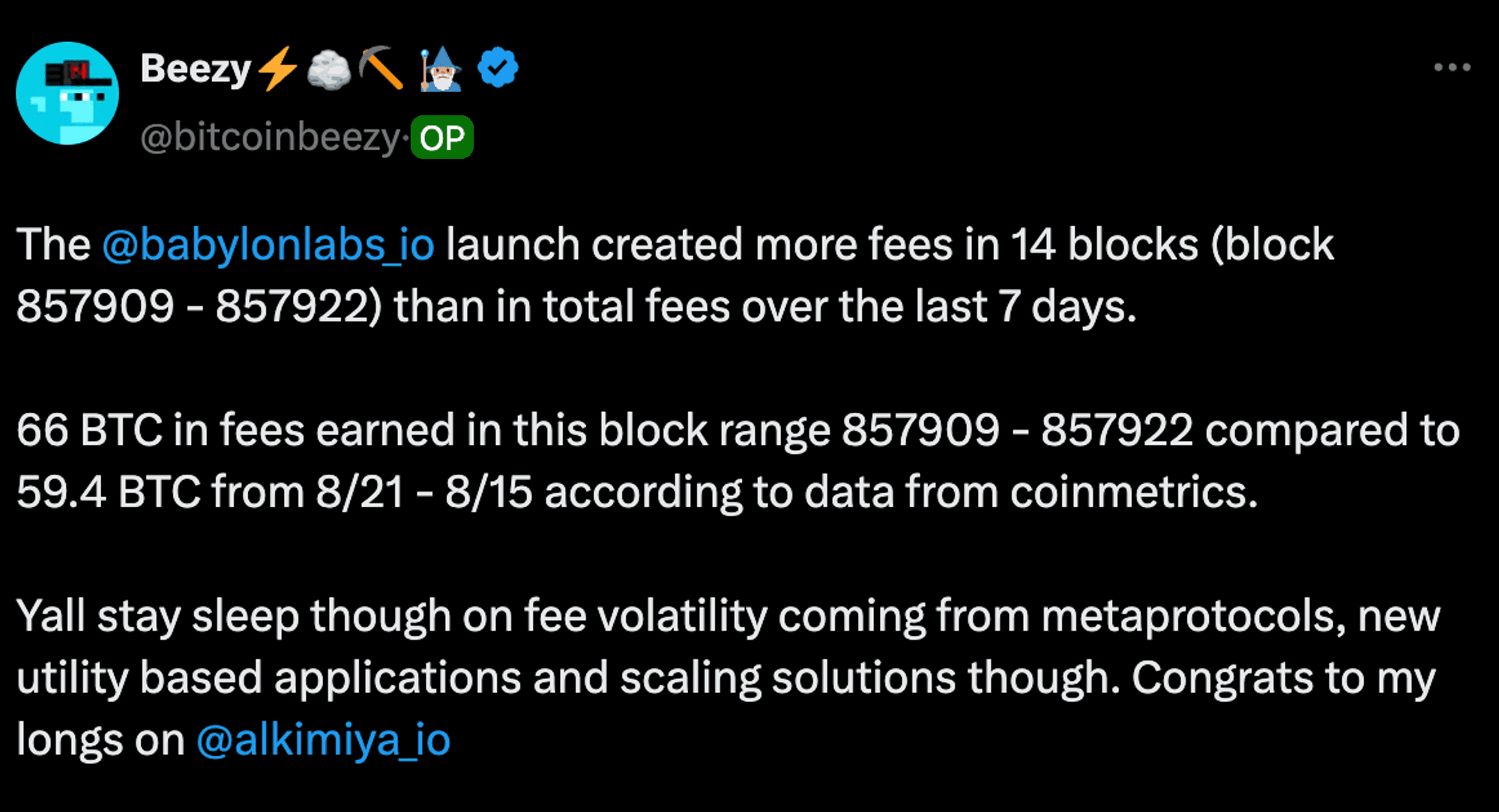

The rush by several Ordinals and Runes projects to mint their collections caused the network fee rate to spike from 70 sat/vB ($6.46 per transaction) to over 1,900 sat/vB ($175 per transaction). Runes recorded the majority of transactions in the first two months, often exceeding 300,000 transactions per day. On 23rd April 2024 alone, investors racked up more than one million transactions in minting, etching, transfers and edicts combined, representing 81.3% of the total Bitcoin network bandwidth.

Bitcoin Runes daily transactions. Source: Dune Analytics

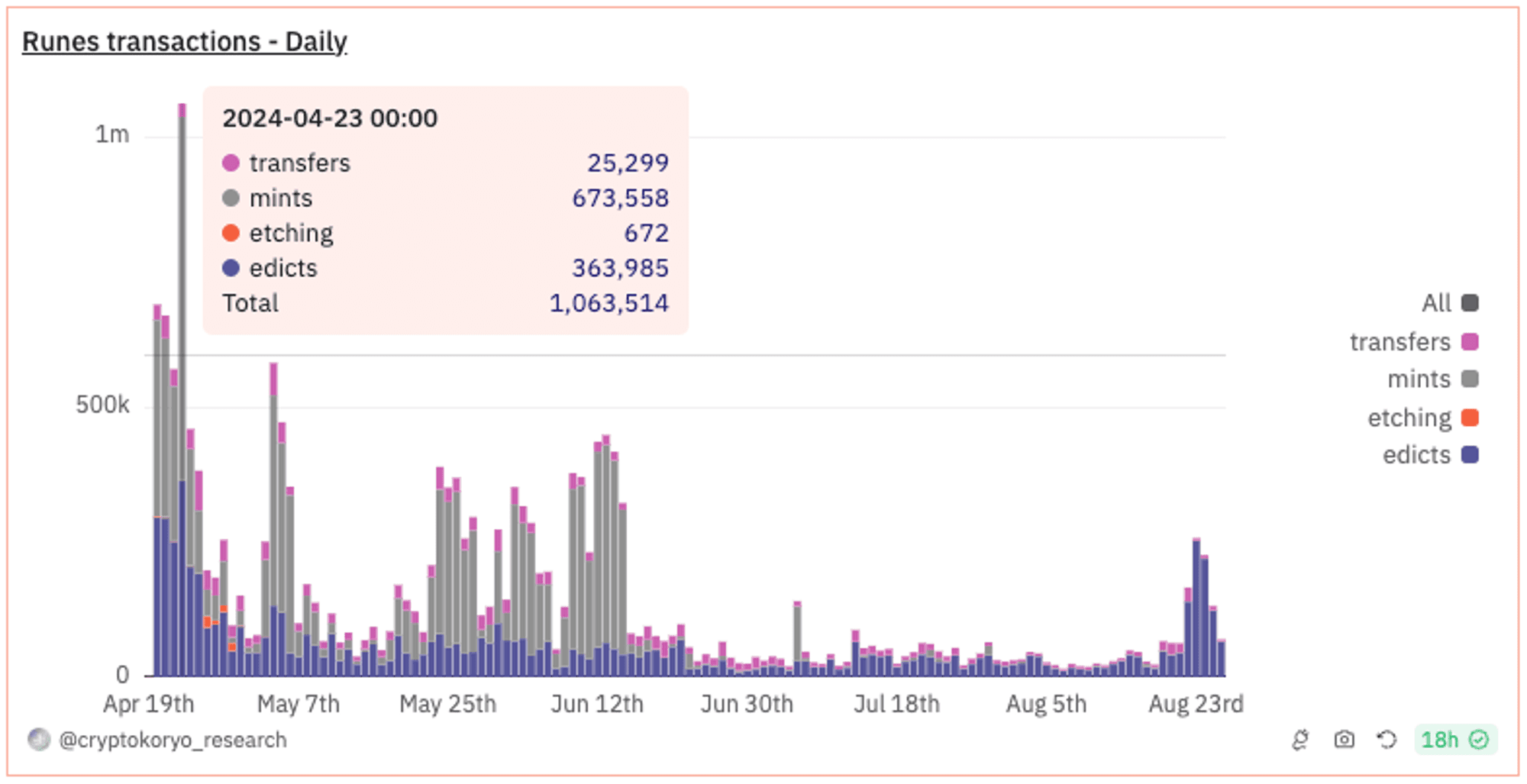

On 7th June 2024, a large number of unconfirmed transactions, estimated at around 333,400, clogged the mempool. This surge stemmed from OKX’s internal wallet management, which seems to have been consolidating its UTXOs.

As OKX began processing wallet transactions starting from block 846,867, they processed over 2,380 transactions with an average fee rate of 246.65 sat/vB. This process cost 254.28 BTC, or roughly $17.6 million.

Bitcoin: Exchange In-House Transactions - OKX. Source: CryptoQuant

This led to fees skyrocketing from 60 sat/vB ($5.80 per transaction) to over 900 sat/vB ($87.80 per transaction) in a single day.

Bitcoin Median Transaction Fees. Source: Alkimiya BTC Transaction Fee Market Dashboard ⌛

How Alkimiya Helped Miners Lock-in Premium

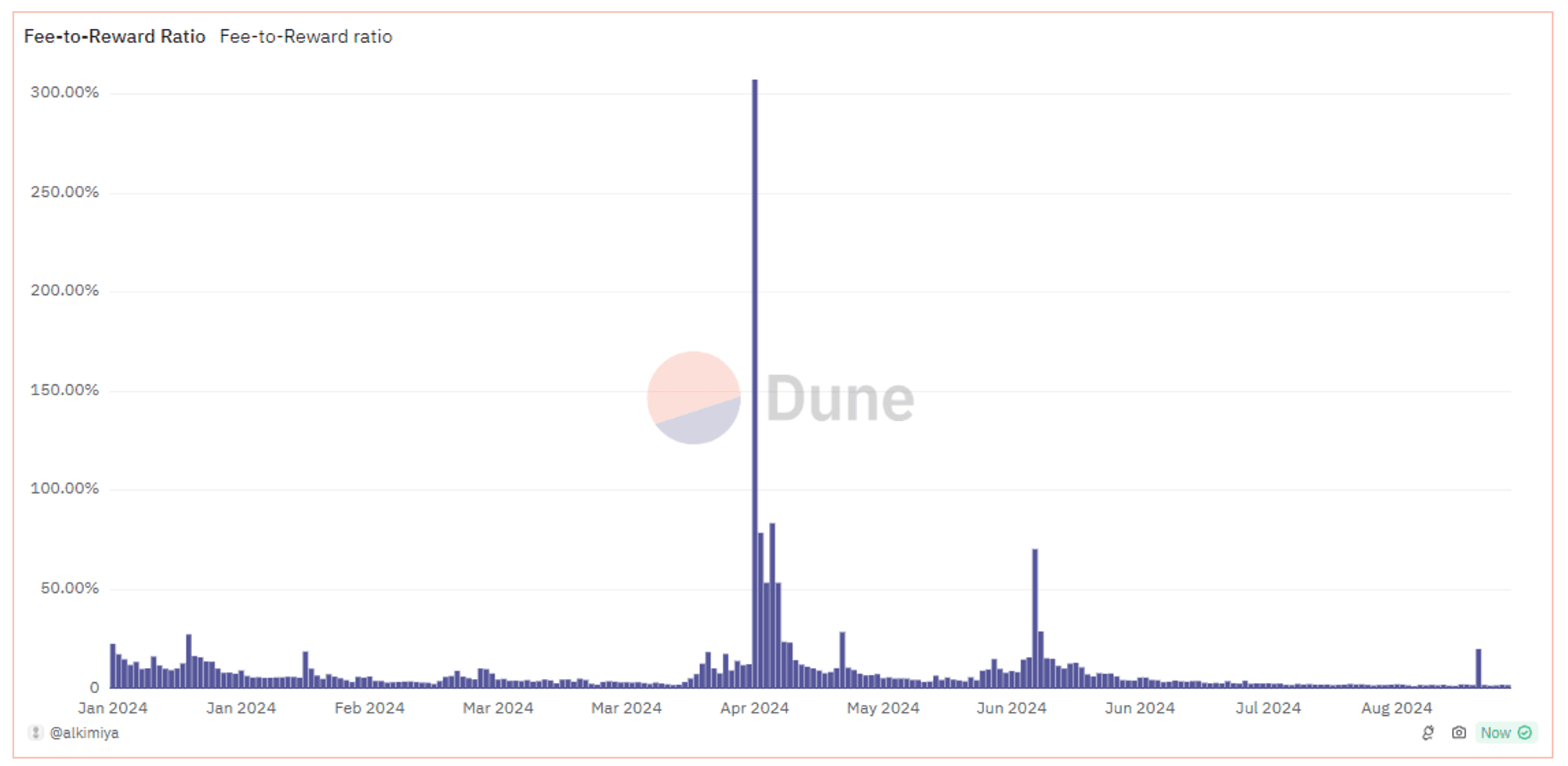

Transaction fees have become a significant portion of miners’ income post-halving, a trend that has introduced new volatility into their revenue. The fees-to-reward ratio for miners now fluctuates dramatically, ranging from 3% to 300%. This volatility presents both opportunities and challenges for miners, who must now navigate a more unpredictable income stream.

Fee-to-Reward ratio. Source: Alkimiya BTC Transaction Fee Market Dashboard ⌛

Mining companies facing high operating costs have been seeking hedging instruments to mitigate the risks from increased volatility.

Historically, BTC feerate buyers consistently pay a premium over spot feerate to hedge against the volatility. The higher the volatility, the greater the premium. Since miners are natural producers of transaction fees, by selling future BTC fees on Alkimiya, miners can capture the high premium by locking in future fee revenues, especially during high network congestion.

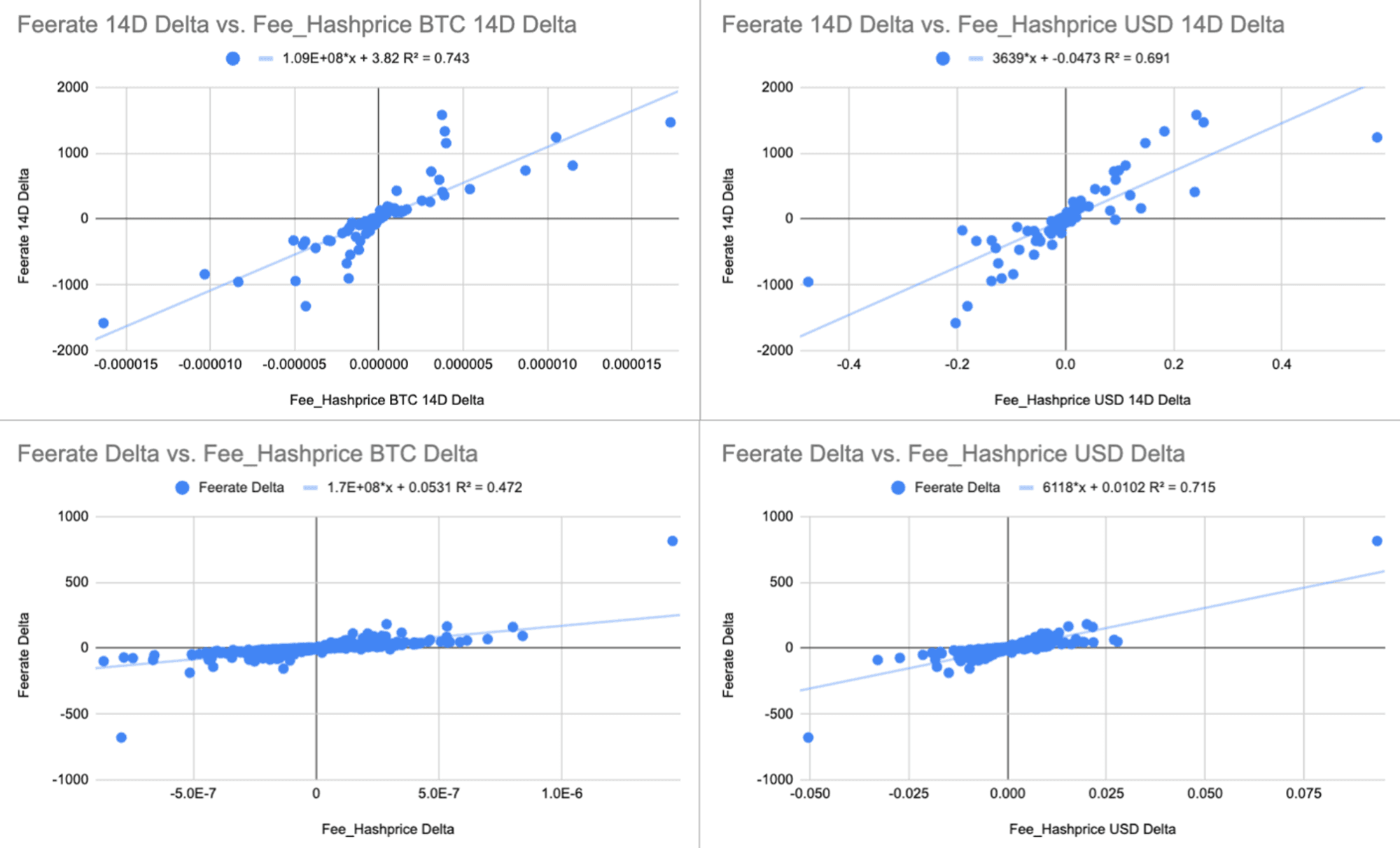

BTC transaction feerate exhibits strong correlation with the fee component of hashprice over 14D and on a daily basis:

Conclusion

These events are not isolated incidents but part of a pattern. As the BTC ecosystem grows, more such occurrences are to be expected. Upcoming launches like Babylon Phase 2 and a series of metaprotocols in late 2024 may trigger similar fee spikes. The volatility of resource pricing hinders the growth of organizations that frequently settle on-chain, and leaks negative externalities that affect regular users.

Transaction fees significantly influence user experience and, by extension, the adoption of blockchains. The risks of high and volatile fees were starkly illustrated in May 2022 when Yuga Labs, the creator of Bored Ape Yacht Club NFT collection, faced significant criticism during a high-profile incident. In response, Yuga Labs took the step of refunding users’ gas fees, highlighting the potential for fee spikes to damage user relations and brand reputation.