Apr 19, 2024

“From this, he inferred a profound principle: that the whole of nature was greater than the sum of its parts, each component interacting with others in complex ways to sustain the balance and harmony of the whole.”

– Ibn Tufayl, Hayy ibn Yaqzan

Overview

Alkimiya is a pioneering blockspace resource protocol that serves as the backbone for powering predictable transaction fee experiences across service providers and end users. At its core, Alkimiya is a peer-to-peer markets protocol that enables the creation, trading, and settlement of synthetic blockspace resources, such as BTC transaction fees and ETH baseFee. Through Alkimiya’s SDK and its frontend marketplace, service providers such as wallets, paymasters, bridges, traders, and dApps can offset their on-chain expenditures or improve their end users’ fee experience.

Problem Statement

Public blockchains have finite capacity for full-node resources, and all on-chain actions compete for inclusions and orderings via transaction fees.

The supply of blockspace is inelastic, but the demand is ephemeral. Fee volatility impedes the growth of on-chain organizations and introduces negative externalities that impact everyday users. While scaling solutions can reduce the amount of full-node resources consumed, pricing the access to them real-time is a fundamentally market-based challenge that requires market-based solutions.

Today, most on-chain services and businesses either absorb the cost themselves, or dump the costs entirely onto users, which can provoke severe backlash when traffic is high. To onboard the next billion users, blockspace resources must be priced and managed. The mission of Alkimiya is to provide a better experience through stable transaction fees for as many ecosystem participants as possible.

Introducing Alkimiya Protocol

Every on-chain action has a rippling effect on transaction fees. Previously, users and service providers had little recourse against these wild swings. Now, they can capitalize on this exposure using Alkimiya.

Users can enter into long or short positions on specific blockspace resources, such as an index that tracks the average BTC transaction fees for specific periods. Upon entering into a long or short position, the user receives NFTs (ERC-1155) representing their positions in a SilicaPool. The design is inspired by Tibetan sand mandalas, renowned for their intricate pattern and spiritual depth. The monks dedicate months to meticulously craft them with colored sand, only to ceremoniously destroy them upon completion, signifying the Buddhist principle of impermanence (Anicca in Pali).

A SilicaPool is the set of all long and short positions within the same period (e.g. May 1 - May 15). Users can enter, trade, or close their positions anytime during the SilicaPool’s period. The payout tracks the rolling average of the index since the start. BTC Tx Fees for example, upon settlement its final payout is based on the average of the median BTC/kB per block across all blocks during those 15 days.

The market consists of two smart contracts: SilicaPools and SilicaIndex. SilicaPools is responsible for the opening, settling, and trading of these positions, while its oracle, SilicaIndex, provides the necessary data to settle these positions. Trading within the protocol is facilitated through an off-chain orderbook service.

Alkimiya is designed with the intention of providing services providers with the best hedging experience. Analogous to how utilities companies lock-in their monthly average power cost via energy futures, on-chain services and end users can offset transaction fees expenditure by subscribing to monthly Pools.

The target groups' needs led to the specific design choice: calculating the payout over all blocks across a period, covering the “area under the curve”, rather than timing specific entry vs. exit points one would on a perp-dex. The averaging effect smoothes out the wild swings and narrows down the range of “contract premium”, and therefore easier for the long and short orders to match. Since the payouts are based on average-over-period, the SilicaPools have calendar expiries. This encourages most trading activities to be front loaded, and hodling towards the end. Long term pools provide superior hedging experience for frequent consumers of blockspace, whereas short term pools still retain the sensitivity to sudden congestions.

Further reading: Welcome to Alkimiya Protocol.

Case Study: BTC Tx Fees

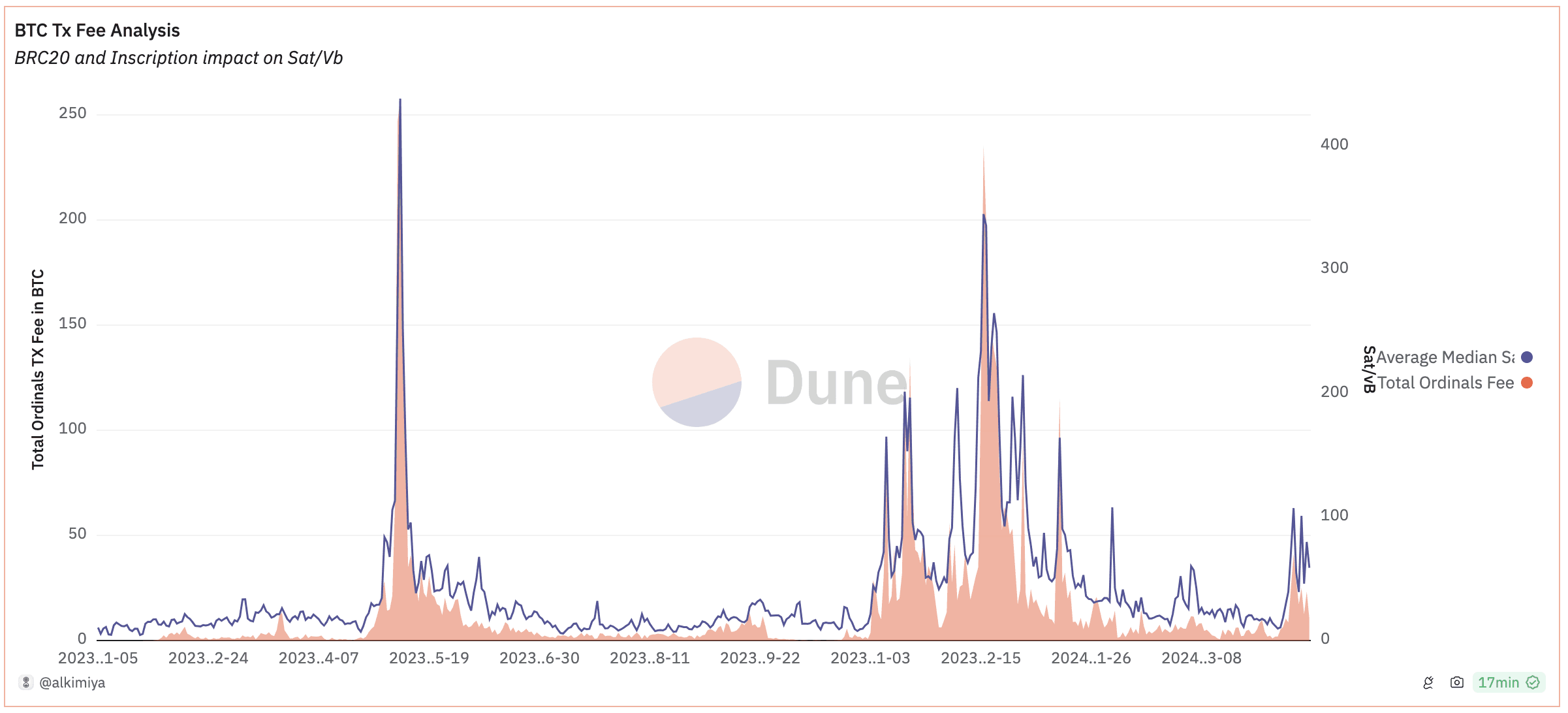

Ordinals sparked a feverish interest in Bitcoin blockspace. At its peak, we've observed BTC fees increasing from 20x to 500x, depending on the week.

Source: Dune

By taking a long position on transaction fees, traders/investors can capitalize on heightened network activities. Ordinal collectors can offset the surge in mint costs, and service providers can hedge against the rising settlement fees expenditure.

By taking a short position on transaction fees, traders/analysts can profit from tapering network activities before fee spikes decay, and miners can secure future fees revenue.

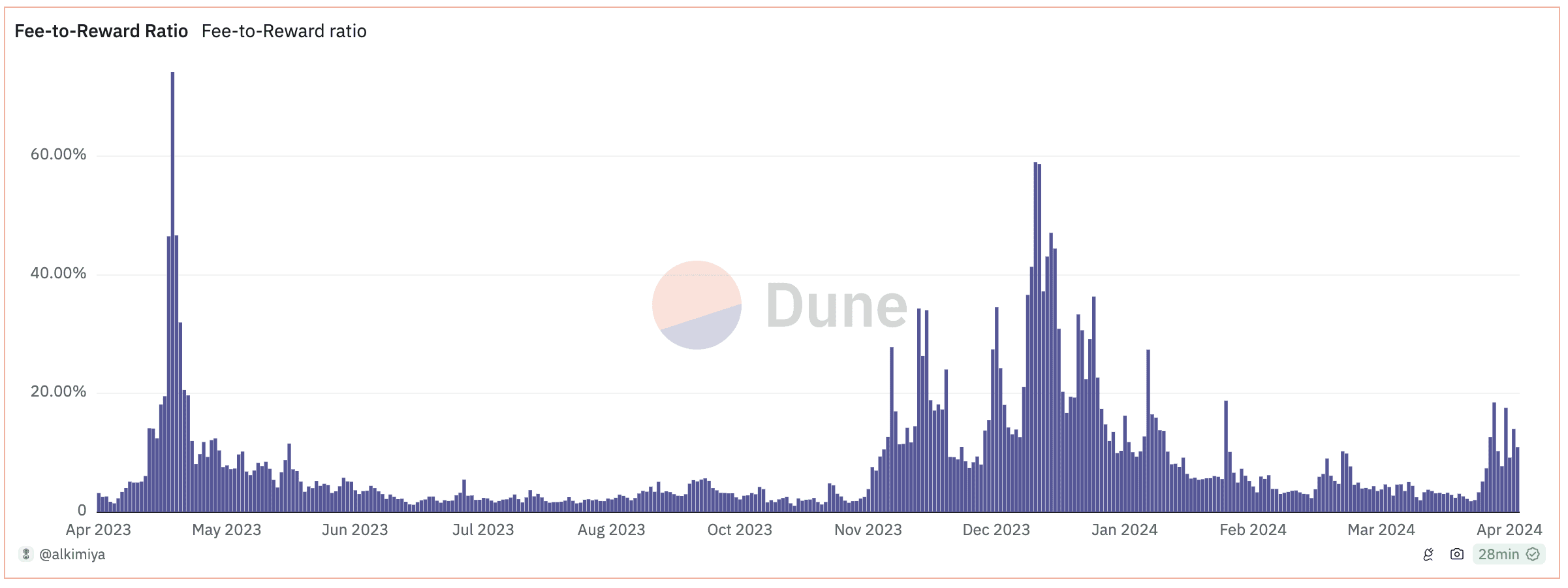

Source: Dune

Trading transaction fees directly offer a superior exposure to the ecosystem’s fundamentals compared to merely holding L1 tokens. While token prices are driven by a variety of unpredictable external factors, transaction fees reflect the true demand.

In short:

Miners: Miners can lock-in future revenue streams by shorting BTC Tx Fees.

Services (wallets, exchanges, market-makers, bridges, L2 operators): On-chain services that frequently settle on BTC can hedge against the volatility by longing BTC Tx Fees.

Ordinals/BRC-20/Runes: Active collectors can offset high mint fees by longing BTC Tx Fees.

On-chain events traders: Traders who analyze on-chain events or network activities trends can trade BTC Tx Fees. Alkimiya allows everyone to capture the impacts from Ordinals, Runes, the halving, or the rise of L2s without cherry-picking specific activities or directly engaging with secondary assets issued atop. This is the pinnacle of "event-driven trading".

Further reading: Tutorial: How to Trade BTC Tx Fees.

What’s next?

Alkimiya is currently live on testnet! Try it here.

Join our Discord and please let us know what you think!

Beyond the BTC Transaction Fees product, Alkimiya will also introduce an ETH Gas products in the near future:

Traders can monetize on the impacts of on-chain events.

Rollups/ paymaster / bridges hedge out gas estimation risks.

Dapps can offer fixed gas prices to users.

The Alkimiya SDK provides abstractions to interact with the Alkimiya network in a TypeScript/JavaScript environment (nodejs, frontend envs, etc), allowing simple integration for end users.

The protocol is designed to be simple and pristine for composability. It has the flexibility to create higher order primitives, such as non-expiring gas tokens, or the Short side selling out-of-money calls whose yield is correlated to the volatility on the blockspace. The possibilities are infinite!

Why is pricing blockspace an important issue to solve?

Transaction fees significantly influence user experience and, by extension, the adoption of blockchains. On Ethereum, despite reliefs from advances in scaling via rollups, DA layers, and EIP-4844, high variance persists due to the structural similarities of nearly all such markets. Over time it leads to a long tail of fragmented blockspace with mercenary capital.

The history of energy futures markets offers a parallel. Every crucial resource—from rice and metals to spices, oil, and semiconductors—has seen the development of robust financial markets. These “paper markets” typically handle volumes much greater than those of the underlying physical assets; what gets priced gets managed.

As the global economy increasingly grows on-chain, blockspace will emerge as one of the most coveted resources of the new era. Alkimiya represents the next step of its evolution. We welcome you to join us.